The Property Cycle - An 18 Year Cyclical Pattern

Following a Cyclical Pattern for Strategic Growth

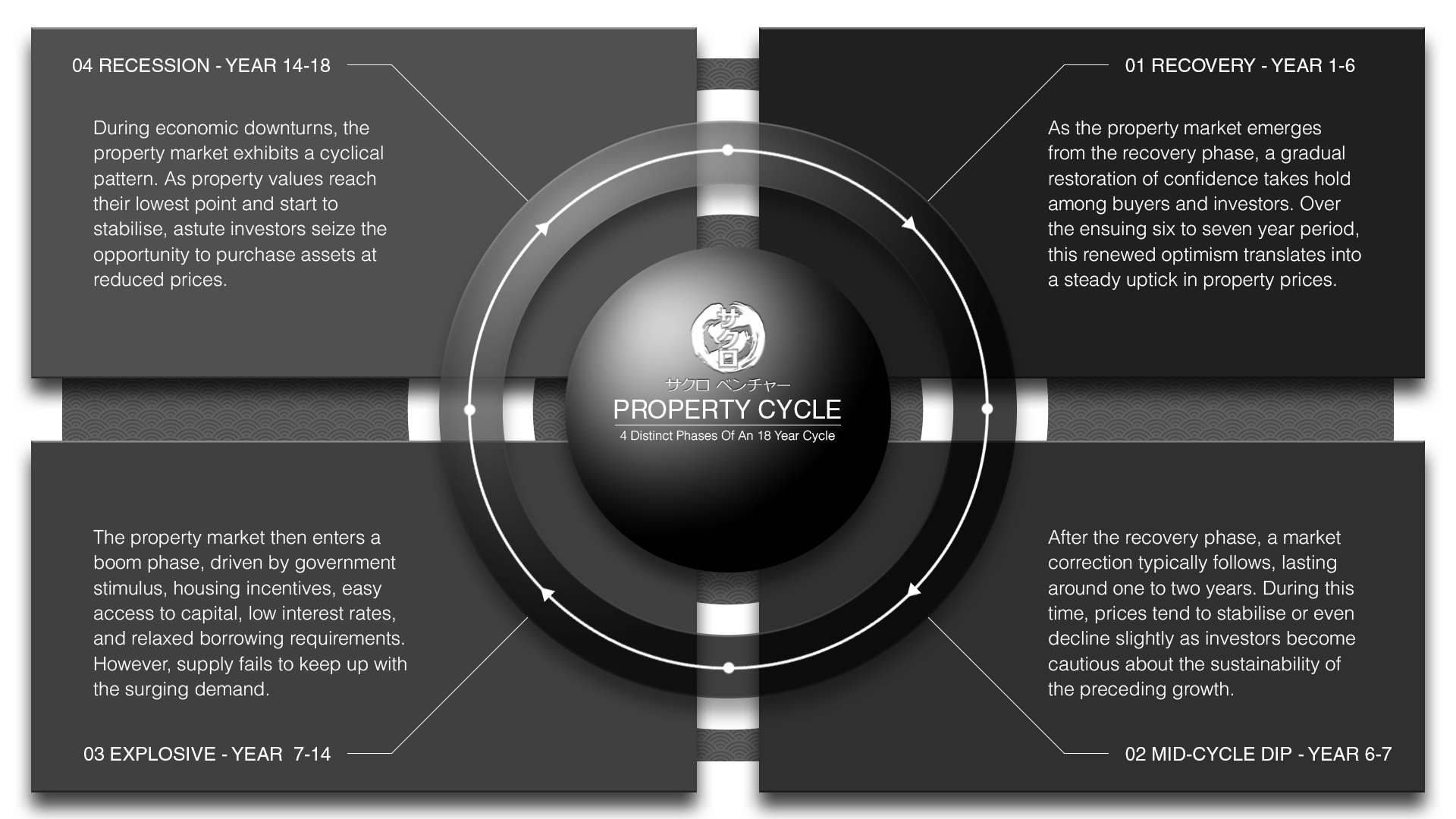

The property market is a complex and dynamic system that exhibits a distinct cyclical pattern, typically spanning an extended period of approximately 18 years from trough to peak and back again.

This prolonged cycle can be further subdivided into four unique phases, each characterised by its own set of market forces, investor sentiment, and economic conditions.

In the immediate aftermath of a property market crash, a recession lasting between 3 to 4 years often takes hold as banks and lending institutions become increasingly risk-averse and tighten their financing criteria, while simultaneously, a glut of properties floods the market, exerting immense downward pressure on prices.

As the market eventually reaches its nadir and investor confidence begins to slowly return, a gradual recovery phase typically ensues over the next 6 to 7 years, marked by a measured uptick in prices as demand reawakens.

However, this recovery is often punctuated by a brief 1 to 2 year period of market correction and price stagnation, as cautious investors reassess the sustainability of the upward trajectory.

Finally, the boom phase of the cycle ignites with explosive force, fueled by a potent combination of government stimulus measures, attractive housing incentives, readily available credit, historically low interest rates, and relaxed borrowing requirements.

This perfect storm of demand-side factors, coupled with a lagging supply response, propels property prices and rents into a steep 5 to 6 year ascent, until the market inevitably reaches its apogee and succumbs to the inexorable forces of another downturn, signaling the commencement of the next 18-year cycle.

The Contrarian Investor - Employing a Cyclical Strategy

The 18-year real estate cycle is a well-documented pattern of boom and bust in property markets, providing astute contrarian investors with lucrative opportunities to capitalise on market inefficiencies.

These savvy individuals possess the foresight and conviction to act against prevailing sentiment, acquiring undervalued assets during the downturn phase when pessimism is rampant and prices are depressed.

By conducting meticulous research, they identify fundamentally sound properties with strong potential for long-term appreciation, underpinned by factors such as location, demographics, and economic prospects.

As the cycle progresses and the market begins to recover, contrarian investors patiently hold their acquisitions, benefiting from rising rental income and gradual price appreciation.

Their disciplined approach and long-term perspective enable them to weather short-term volatility and reap substantial rewards as the market reaches its peak.

Ultimately, the contrarian property investor’s success lies in their ability to think independently, act decisively, and maintain a steadfast focus on value creation throughout the 18-year cyclical pattern.

The Cyclical Property Phase - 2025 Projection

The 18-year property cycle framework, a well-established concept in real estate analysis, suggests that the next significant downturn in the housing market could potentially occur around 2026, based on the timing of the previous major crash that commenced in 2008.

However, it is essential to approach this framework with a degree of caution, as it serves more as a general guide than a precise predictive tool. The intricacies and complexities of the modern economic landscape, further compounded by unforeseen disruptions such as the COVID-19 pandemic, have introduced additional layers of uncertainty into the cycle, making it increasingly challenging to pinpoint our exact position within it with absolute certainty.

Despite these challenges, there are emerging indications that the boom phase may have reached its conclusion in the latter part of 2022, potentially signaling the onset of a crash phase. If this assessment proves accurate, we could already be approximately one year into this downward trend.

Successfully navigating the intricate nuances of the property cycle demands a profound understanding of market dynamics, economic indicators, and historical patterns. Partnering with seasoned and knowledgeable property professionals, such as the experts at Sakuro Ventures, can provide invaluable guidance and support in making well-informed decisions, irrespective of the current stage of the cycle.

Our team of specialists possesses the expertise to offer insightful analysis of market trends, develop effective risk mitigation strategies, and identify unique opportunities that may emerge during different phases of the cycle.

By leveraging this wealth of knowledge and experience, investors and homeowners alike can adapt their approaches and optimise their outcomes in the face of ever-evolving market conditions, positioning themselves for success in both the short and long term.